Cryptocurrency: Revolutionizing the Future of Finance

Cryptocurrency: Revolutionizing the Future of Finance

Cryptocurrency, a digital or virtual form of currency, has emerged as a transformative force in the financial landscape. It is based on decentralized technology known as blockchain, which provides secure and transparent transactions without the need for intermediaries like banks. Since the advent of Bitcoin, the first cryptocurrency, the world of digital currencies has witnessed exponential growth.

Here we will explore the fascinating world of cryptocurrencies, their underlying technology, benefits, challenges, and their potential impact on the future of finance.

What is Cryptocurrency?

Definition and Characteristics:

A cryptocurrency is a form of digital or virtual currency that uses cryptography for security and operates on a decentralized network called the blockchain. It is characterized by its secure and transparent nature, immutability, and absence of central control.

History:

The concept of cryptocurrency was introduced in 2009 with the launch of Bitcoin by an anonymous individual or group known as Satoshi Nakamoto. Since then, thousands of cryptocurrencies have been created, each with its unique features and purposes.

How Cryptocurrencies Work:

Cryptocurrencies operate on blockchain technology, which is a distributed ledger that records all transactions across a network of computers. Transactions are verified and added to the blockchain through a consensus mechanism, such as proof of work or proof of stake.

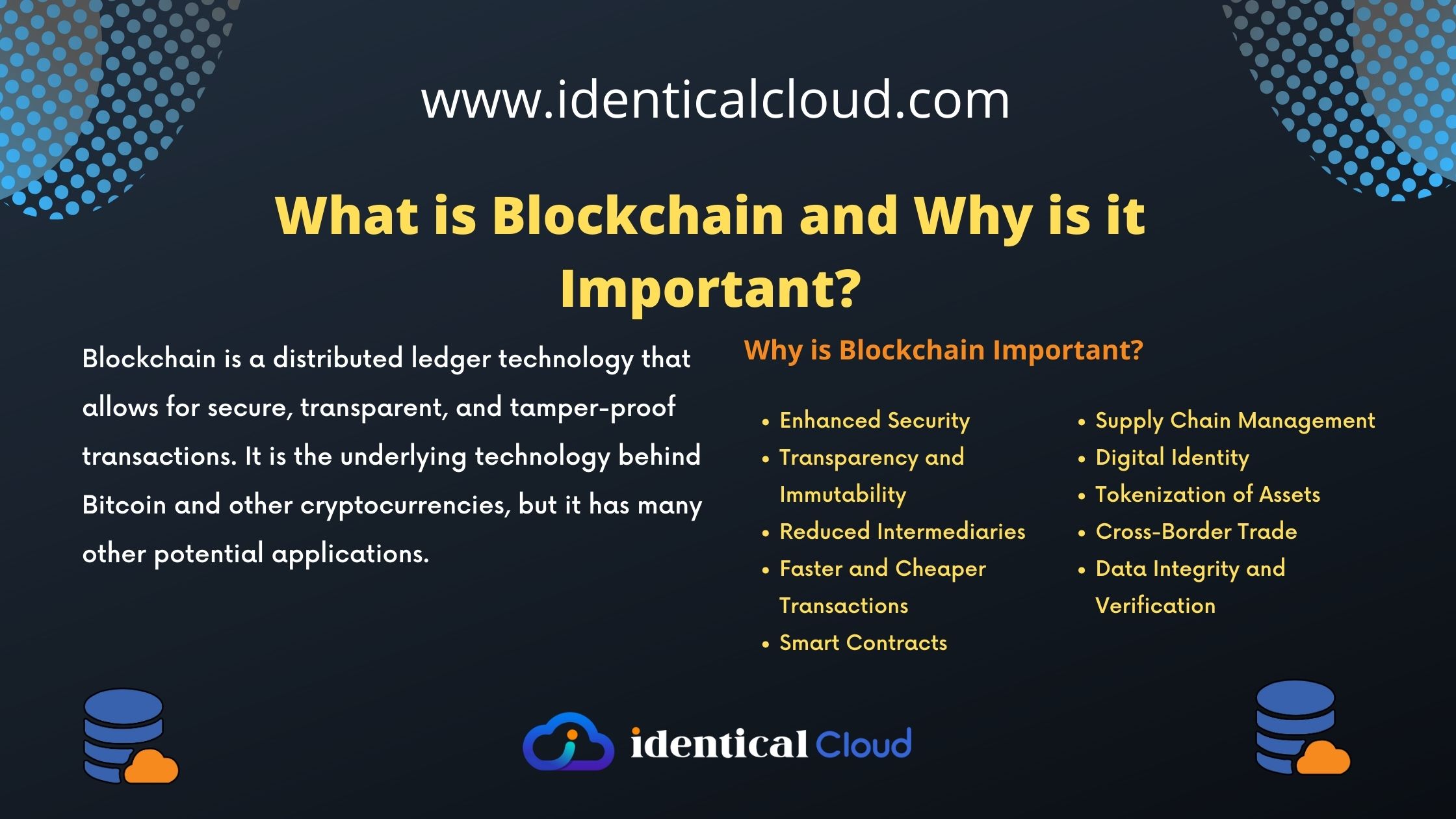

The Blockchain Technology:

Understanding Blockchain:

Blockchain is a decentralized ledger that consists of a chain of blocks, each containing a list of verified transactions. It ensures transparency, security, and immutability by storing data across multiple nodes in a network.

Decentralization and Transparency:

Decentralization eliminates the need for intermediaries and enables peer-to-peer transactions. Transparency in blockchain allows anyone to view and verify transactions, enhancing trust and accountability.

Security and Immutability:

Cryptographic techniques used in blockchain ensure the security of transactions and protect against fraud. Once a transaction is recorded on the blockchain, it becomes immutable, making it tamper-proof.

Popular Cryptocurrencies:

Bitcoin (BTC):

Bitcoin is the first and most well-known cryptocurrency, introduced as a peer-to-peer electronic cash system. It paved the way for the development of other cryptocurrencies.

Ethereum (ETH):

Ethereum is a blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). It introduced the concept of programmable blockchain.

Ripple (XRP):

Ripple is both a digital payment protocol and a cryptocurrency. It aims to facilitate fast and low-cost international money transfers.

Litecoin (LTC):

Litecoin is a peer-to-peer cryptocurrency that offers faster transaction confirmation times and a different hashing algorithm than Bitcoin.

Other Prominent Cryptocurrencies:

There are numerous other cryptocurrencies with unique features and use cases, including Bitcoin Cash (BCH), Cardano (ADA), and Binance Coin (BNB).

Benefits of Cryptocurrency:

Decentralization and Elimination of Intermediaries:

Cryptocurrencies enable direct peer-to-peer transactions without the need for intermediaries like banks, reducing transaction costs and increasing efficiency.

Enhanced Security and Privacy:

Cryptocurrencies utilize cryptographic techniques to ensure secure transactions and protect user privacy.

Global Accessibility and Financial Inclusion:

Cryptocurrencies provide access to financial services for the unbanked population worldwide, promoting financial inclusion.

Lower Transaction Fees:

Compared to traditional financial systems, cryptocurrency transactions often have lower fees, particularly for cross border or international transactions.

Potential for High Returns:

Cryptocurrencies have the potential for high returns on investment, attracting investors looking for new opportunities.

Challenges and Risks:

Volatility and Market Speculation:

Cryptocurrency markets are known for their high volatility, making them subject to price fluctuations and speculation.

Regulatory Concerns:

The regulatory landscape for cryptocurrencies varies across countries, creating uncertainty and challenges for adoption and mainstream integration.

Security Risks and Hacks:

While blockchain technology is secure, cryptocurrency exchanges and wallets can be vulnerable to hacking and security breaches.

Scalability Issues:

Scalability remains a challenge for many cryptocurrencies, as the technology needs to support a large number of transactions simultaneously.

Environmental Impact:

The energy consumption associated with cryptocurrency mining has raised concerns about its environmental impact.

Cryptocurrency Mining:

Proof of Work (PoW) vs. Proof of Stake (PoS):

Cryptocurrency mining involves the process of validating and adding transactions to the blockchain. It can be done through either proof of work or proof of stake mechanisms.

Mining Process and Energy Consumption:

Cryptocurrency mining requires powerful computer hardware and consumes a significant amount of energy, leading to debates about sustainability.

Cryptocurrency Wallets and Exchanges:

Types of Wallets:

Cryptocurrency wallets store private keys and enable users to manage their digital assets. They can be hardware, software, or web-based.

Security Considerations:

Choosing secure wallets and implementing best practices, such as two-factor authentication, is crucial for protecting cryptocurrency holdings.

Cryptocurrency Exchanges:

Exchanges facilitate the buying, selling, and trading of cryptocurrencies. It’s important to select reputable exchanges with robust security measures.

Cryptocurrency and the Future of Finance:

Disrupting Traditional Financial Systems:

Cryptocurrencies have the potential to disrupt traditional financial systems by offering alternative forms of currency, payment systems, and financial instruments.

Central Bank Digital Currencies (CBDCs):

Governments and central banks are exploring the development of CBDCs, which are digital currencies issued by central authorities.

Potential Use Cases and Industries:

Cryptocurrencies can have applications beyond finance, such as supply chain management, healthcare, and voting systems.

Integration with Emerging Technologies (AI, IoT, etc.):

The integration of cryptocurrencies with emerging technologies like artificial intelligence and the Internet of Things can unlock new possibilities and innovations.

Regulation and Legal Considerations:

Global Regulatory Landscape:

Cryptocurrency regulations vary across countries, with some embracing it, others imposing restrictions, and some still developing frameworks.

AML/KYC Compliance:

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are becoming increasingly important in the cryptocurrency ecosystem to prevent illicit activities.

Taxation and Reporting:

Cryptocurrency transactions may be subject to taxation, and individuals and businesses should comply with tax obligations and reporting requirements.

Cryptocurrency has emerged as a groundbreaking innovation with the potential to revolutionize the financial industry. The decentralized nature of cryptocurrencies, powered by blockchain technology, offers numerous benefits such as increased security, privacy, and accessibility.

However, challenges such as volatility, regulatory concerns, and scalability issues need to be addressed for widespread adoption. As cryptocurrencies continue to evolve and gain mainstream acceptance, they are likely to reshape the future of finance