Top Nuclear Energy ETFs

Top Nuclear Energy ETFs

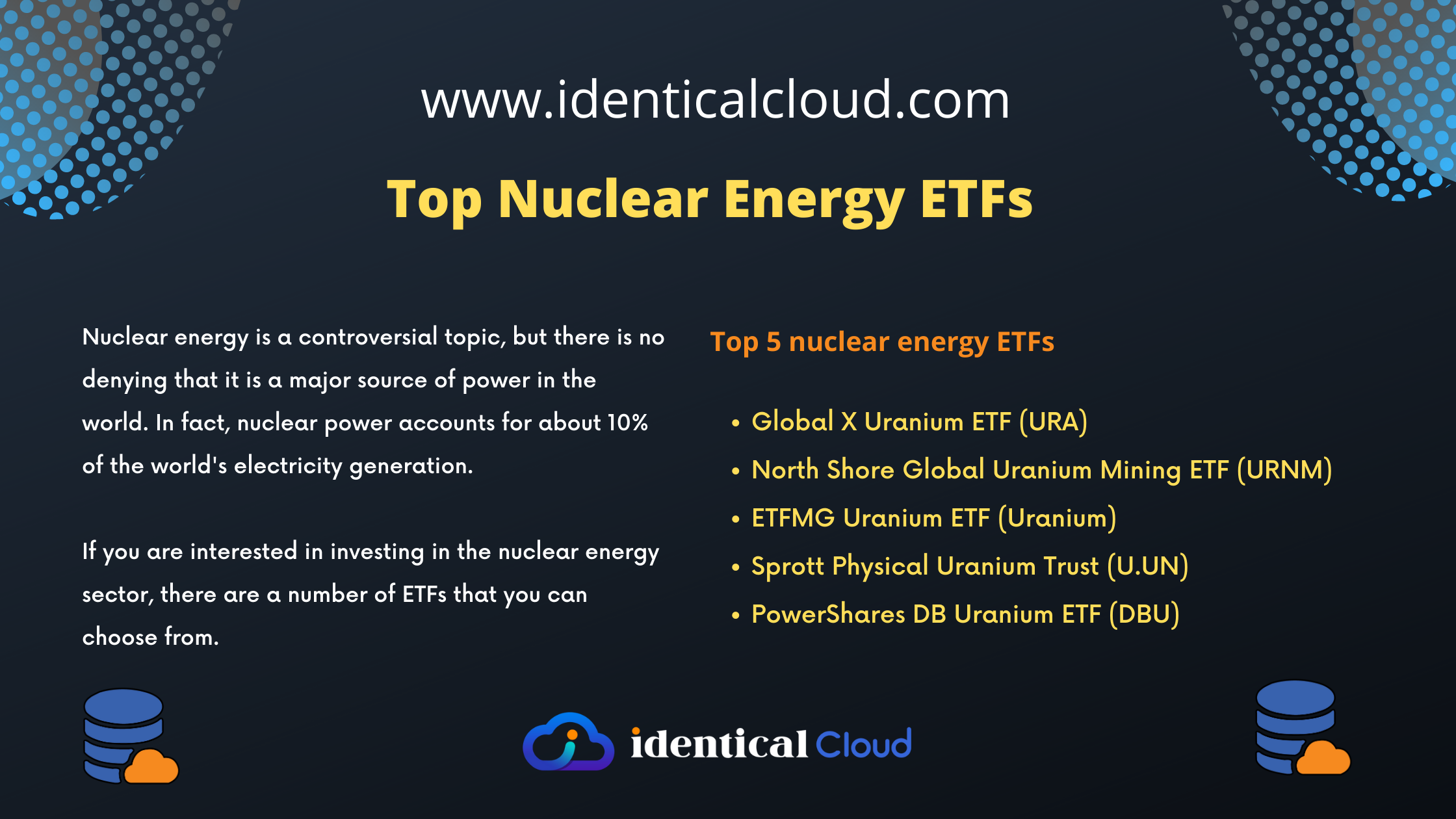

Nuclear energy is a controversial topic, but there is no denying that it is a major source of power in the world. In fact, nuclear power accounts for about 10% of the world’s electricity generation.

What is an ETF and how does it work?

An exchange-traded fund (ETF) is a type of security that tracks an index, a basket of assets, or a commodity. ETFs are traded on exchanges just like stocks, and their prices fluctuate throughout the day.

ETFs offer a number of advantages over traditional mutual funds, including:

- Transparency: ETF prices are transparent, as they are determined by supply and demand on the open market.

- Liquidity: ETFs are highly liquid, meaning that they can be bought and sold easily.

- Cost-effectiveness: ETFs are typically less expensive than mutual funds, as they have lower management fees.

There are two main types of ETFs: index ETFs and actively managed ETFs. Index ETFs track a specific index, such as the S&P 500 or the Dow Jones Industrial Average. Actively managed ETFs are managed by a team of professionals who try to outperform the market.

To invest in an ETF, you can open an account with a brokerage firm and purchase shares of the ETF that you want to own. You can also buy and sell ETFs through a robo-advisor.

Here are some of the benefits of investing in ETFs:

- Low fees: ETFs typically have lower fees than mutual funds.

- Diversification: ETFs can help you diversify your portfolio by investing in a variety of assets.

- Liquidity: ETFs are highly liquid, meaning that you can easily buy and sell them.

- Transparency: ETF prices are transparent, as they are determined by supply and demand on the open market.

If you are interested in investing in the nuclear energy sector, there are a number of ETFs that you can choose from. Here are the top 5 nuclear energy ETFs:

Global X Uranium ETF (URA):

URA(Global X Uranium ETF) is the largest nuclear energy ETF, with over $1 billion in assets under management. It tracks the performance of the Solactive Global Uranium Index, which includes uranium mining companies, uranium producers, and uranium explorers.

North Shore Global Uranium Mining ETF (URNM):

URNM is a smaller ETF with about $400 million in assets under management. It tracks the performance of the MVIS Global Uranium Miners Index, which includes uranium mining companies that are actively engaged in the exploration, development, and production of uranium.

ETFMG Uranium ETF (Uranium):

Uranium is a newer ETF with about $200 million in assets under management. It tracks the performance of the Indxx Uranium Index, which includes uranium mining companies, uranium producers, and uranium explorers.

Sprott Physical Uranium Trust (U.UN):

U.UN is a physical uranium trust that holds physical uranium in trust for its shareholders. This means that the trust owns the underlying uranium, which gives investors exposure to the uranium market without having to deal with the complexities of owning uranium mining stocks.

PowerShares DB Uranium ETF (DBU):

DBU is a leveraged ETF that provides 2x exposure to the performance of the Solactive Global Uranium Index. This means that for every 1% increase in the index, DBU will increase by 2%.

When choosing a nuclear energy ETF, it is important to consider your investment goals and risk tolerance. If you are looking for a long-term investment, URA or URNM may be a good option. If you are looking for a more speculative investment, Uranium or DBU may be a better choice.

It is also important to remember that nuclear energy is a volatile sector, so you should be prepared for the possibility of significant price swings. However, if you are willing to take on some risk, nuclear energy ETFs can be a way to gain exposure to a growing sector with the potential for significant returns.